Overpayments by ATMs and theft from banks

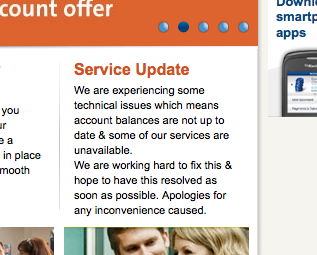

In June 2012, a massive IT failure affected all of Ulster Bank’s ATMs, and many customers sought to take advantage by making multiple withdrawals of cash which they did not have in their accounts. As I have commented many times on this blog, in the case of overactive ATMs, overpayments, and theft, a bank error in your favour is not a gift from God; an overactive ATM is not santa, and the scrooge bank will have to be repaid; bank errors are not a licence to gamble; and keeping the proceeds of a bank error in your favour can amount to theft.

In June 2012, a massive IT failure affected all of Ulster Bank’s ATMs, and many customers sought to take advantage by making multiple withdrawals of cash which they did not have in their accounts. As I have commented many times on this blog, in the case of overactive ATMs, overpayments, and theft, a bank error in your favour is not a gift from God; an overactive ATM is not santa, and the scrooge bank will have to be repaid; bank errors are not a licence to gamble; and keeping the proceeds of a bank error in your favour can amount to theft.

However, in a recent prosecution of a man who managed to withdraw €13,600 from Ulster Bank ATMs during the IT failure, the judge dismissed the case as the prosecution failed to prove Ulster Bank did not consent to the withdrawals, and the State had failed to prove the bank existed. The defendant was charged with 23 counts of stealing cash, the property of “Ulster Bank Ireland Ltd”, and whilst there was evidence of various entities associated with Ulster Bank, the judge held that there was no documentary proof of a properly incorporated legal entity called “Ulster Bank Ireland Ltd” put before the jury, and he therefore directed the jury to acquit the defendant.…