Another Tale of Two Toms – Restitution of Mistaken Payments, and Interceptive Subtraction, again – updated

Actor Tom Hollander (imdb | wikipedia | image source) told an anecdote to Seth Meyers on the Late Night tv show (geoblocked NCB clip | YouTube clip), about when he received a bonus payslip meant for actor Tom Holland (imdb | wikipedia | image source). At the time, the two actors shared an agent, who obviously mixed up his own clients, so it’s not a surprise that the rest of us do too. For example, after the casting of Captain America: Civil War (2016 | imdb) was announced, I thought it was a brave decision to have Mr Collins play Spiderman! Hollander’s story relates to one of Holland’s subsequent outings as Spiderman. Hollander told Meyers that he got an email containing Holland’s first box office bonus payslip for The Avengers: Infinity War (2018 | imdb). Hollander said that it was for an “astonishing amount of money”.

Writing in The Guardian, Stuart Heritage commented that this is “a nice little insight into the world where there are too many famous Toms with similar surnames”. Indeed, not only are there too many Toms with the same surnames, sometimes they receive each other’s money, not merely the payslip.…

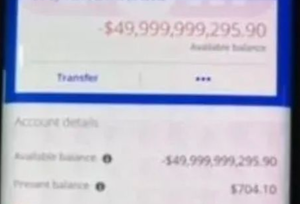

Walter Sisulu University (WSU) student Sibongile Mani [left] has been sentenced to five years’ imprisonment for theft relating to R14 million [€870,000] accidentally credited to her account by the National Student Financial Aid Scheme (NSFAS) in 2017.

Walter Sisulu University (WSU) student Sibongile Mani [left] has been sentenced to five years’ imprisonment for theft relating to R14 million [€870,000] accidentally credited to her account by the National Student Financial Aid Scheme (NSFAS) in 2017.